PAN Card Online in 5 Minutes | Download e pan🪪

Instant e-PAN: Get your PAN card online in just 5 minutes! Download your e-PAN from the Income Tax Department website using your Aadhaar number.

The Instant e-PAN service is available to all Individual taxpayers, who have not been allotted a Permanent Account Number (PAN) but possess Aadhaar. This is a pre-login service, where you can:

Obtain digitally signed PAN in electronic format, free of cost, with the help of Aadhaar and your mobile number linked with Aadhaar,

Update PAN details as per Aadhaar e-KYC,

Create e-Filing account based on e-KYC details after allotment / updation of PAN, and

Check status of pending e-PAN request / Download e-PAN either before or after logging in to the e-Filing portal.

Generate New e-PAN:

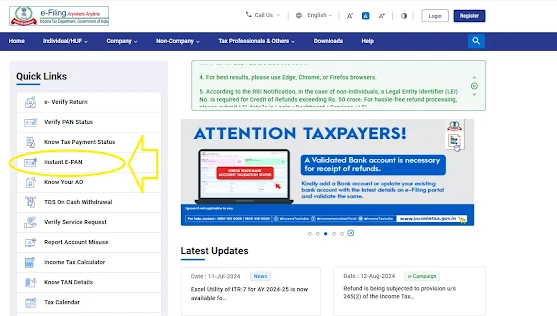

Visit the official income tax e-filing website.

Click on “Instant e-PAN.”

On the e-PAN page, select “Get New e-PAN.”

Enter your 12-digit Aadhaar number, confirm, and proceed12.

Note:

- If the Aadhaar is already linked to a valid PAN, the following message is displayed - Entered Aadhaar Number is already linked with a PAN.

- If the Aadhaar is not linked with any mobile number, the following message is displayed - Entered Aadhaar Number is not linked with any active mobile number.

On successful verification by Adhaar OTP, verify and submit your details.

Download Your e-PAN:

There are no charges for downloading the instant e-PAN card.

Visit the e-filing website.

Under the “Check Status/Download PAN” tab, click “Continue.”

Enter your Aadhaar number and the OTP sent to your registered mobile

No comments:

Post a Comment

Thanks for comment. For any query you may directly contact camanishmalhotra@gmail.com

Note: Only a member of this blog may post a comment.